What is Real Estate Investing?

Real estate investing is a popular way to build wealth . Real estate investors buy, lease, and eventually sell properties to make a profit . This guide explores what it means to be a real estate investor, covering different types of real estate investments, investment strategies , and potential challenges.

Different Real Estate Investment Options

1. Residential Real Estate

- Single-Family Homes: Houses meant for single-family occupancy. These are common among novice investors due to their affordability and easier management .

- Multi-Family Properties: Real estate that accommodates several families, like apartment buildings and multiplexes. They offer higher rental income but need increased oversight .

- Vacation Rentals: Homes leased for short stays, typically via sites like Airbnb. These can yield more profit but may have more frequent vacancies and require active management .

2. Investing in Commercial Properties

- Office Buildings: Properties used for office rentals. They often have long-term leases , offering consistent revenue .

- Retail Properties: Buildings leased to retail businesses, such as shopping centers, malls, and storefronts. Success is linked to the success of the tenants .

- Industrial Properties: Industrial buildings such as factories and storage units. These have protracted agreements and require little oversight.

3. Investing in Industrial Properties

- Warehouses: Storage facilities for merchandise and materials. Demand is increased by the rise in e-commerce.

- Manufacturing Facilities: Properties where products are manufactured. These demand specific expertise for investment.

- Distribution Centers: Central points for shipping and logistics. High demand in supply chain management .

4. Investing in Land

- Undeveloped Land: Land that has not been improved or built upon. It offers potential for development but can be uncertain.

- Developed Land: Parcels that are development-ready. Requires significant investment and development expertise .

- Agricultural Land: Land dedicated to farming and livestock. Offers long-term stability but requires knowledge of agricultural markets .

Real Estate Investment Strategies

1. Long-Term Holding Strategy

- Overview: Acquire and lease properties long-term to enjoy rental income and appreciation.

- Pros: Regular income, tax incentives, and increased property value over time.

- Cons: Requires property management, tied-up capital, market risk.

2. Fix and Flip

- Overview: Acquire, renovate, and quickly sell properties.

- Pros: Potential for high short-term profits, ability to improve property value.

- Cons: High risk, requires construction knowledge, market timing crucial.

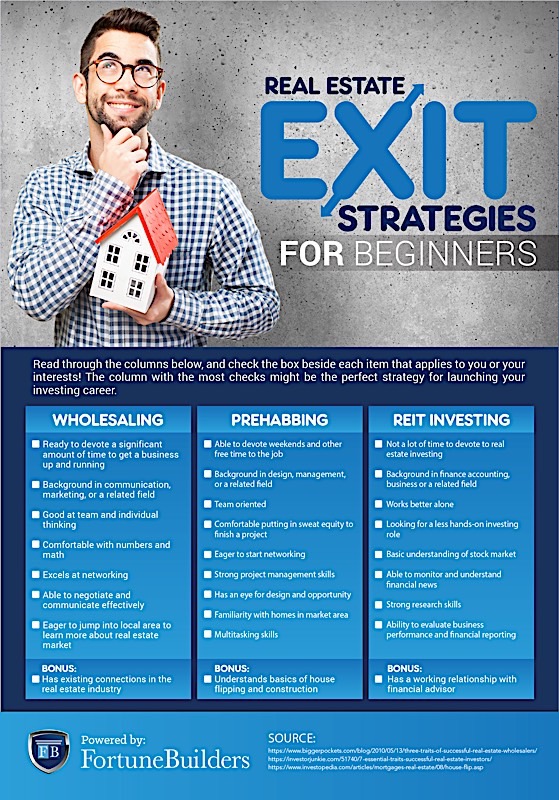

3. Wholesaling

- Overview: Locate undervalued homes, contract them, and transfer the contract for a fee.

- Pros: Requires little capital, fast deals, no property upkeep.

- Cons: Dependent on finding deals and buyers, smaller profits.

4. Investing in REITs

- Overview: Invest in a company that owns and operates income-producing real wholesale a house estate. REITs are traded on stock exchanges.

- Pros: Liquid investment, diversified portfolio, passive earnings, managed professionally.

- Cons: Market volatility, less control, fees and expenses.

5. Real Estate Crowdfunding

- Overview: Invest collectively in real estate projects via crowdfunding sites.

- Pros: Affordable entry, diverse investments, involvement in significant projects.

- Cons: Lack of direct control, associated fees, inherent risks.

How to Become a Real Estate Investor

Education and Research:

Learn the Basics: Gain knowledge about real estate trends, funding methods, property upkeep, and investment approaches.

Networking: Join real estate investment groups, attend seminars, and connect with experienced investors.

Set Investment Goals:

Define Objectives: Determine your investment goals, such as income generation, capital appreciation, or portfolio diversification.

Set Investment Goals

- Define Objectives: Clarify your investment aims, focusing on income, growth, or diversification.

- Risk Tolerance: Assess your risk tolerance and choose investment strategies that align with it.

Develop a Business Plan

- Market Analysis: Analyze markets, property categories, and expected returns.

- Financing Strategy: Prepare a financing plan using mortgages, private loans, how do you wholesale real estate and savings.

Build a Team

- Key Professionals: Gather a team of agents, lawyers, accountants, managers, and contractors.

- Networking: Maintain and grow your network of helpful professionals.

Start Small

- Initial Investment: Begin with smaller properties or simpler projects to gain experience.

- Learn and Adapt: Learn from your initial investments and adjust your strategies accordingly.

Scale Up

- Growth: Expand your investments as your experience and confidence grow.

- Diversification: Broaden your investment portfolio with varied properties and areas.

Challenges and Risks in Real Estate Investing | Potential Challenges and Risks

1. Market Volatility

- Economic Factors: Markets are subject to changes in the economy, interest rates, and policies.

- Mitigation: Monitor market trends and modify strategies accordingly.

2. Property Management

- Tenant Issues: Tenant problems, vacancies, and collecting rent can be difficult.

- Solutions: Use a management company or improve your own management abilities.

3. Financing and Cash Flow

- Funding Challenges: Getting funding and managing cash flow can be challenging.

- Strategies: Have a solid financing plan and maintain a reserve fund for unexpected expenses.

4. Legal and Regulatory Issues

- Compliance: Make sure your investments adhere to legal requirements.

- Advice: Consult with legal professionals to navigate regulations and avoid pitfalls.

Conclusion

Real estate investing can be highly rewarding to grow wealth and meet financial objectives. By understanding different types of investments , creating a solid plan , and understanding potential challenges, you can succeed in real estate investing. Whether you are a novice or veteran investor, staying informed and adaptable are key to building a profitable portfolio.